April 22, 2025

How to Create Customer Trust Through Data: Inside Bank of Hawaii’s Customer Experience Vision

By Jody Bhagat, President Global Banking, Personetics

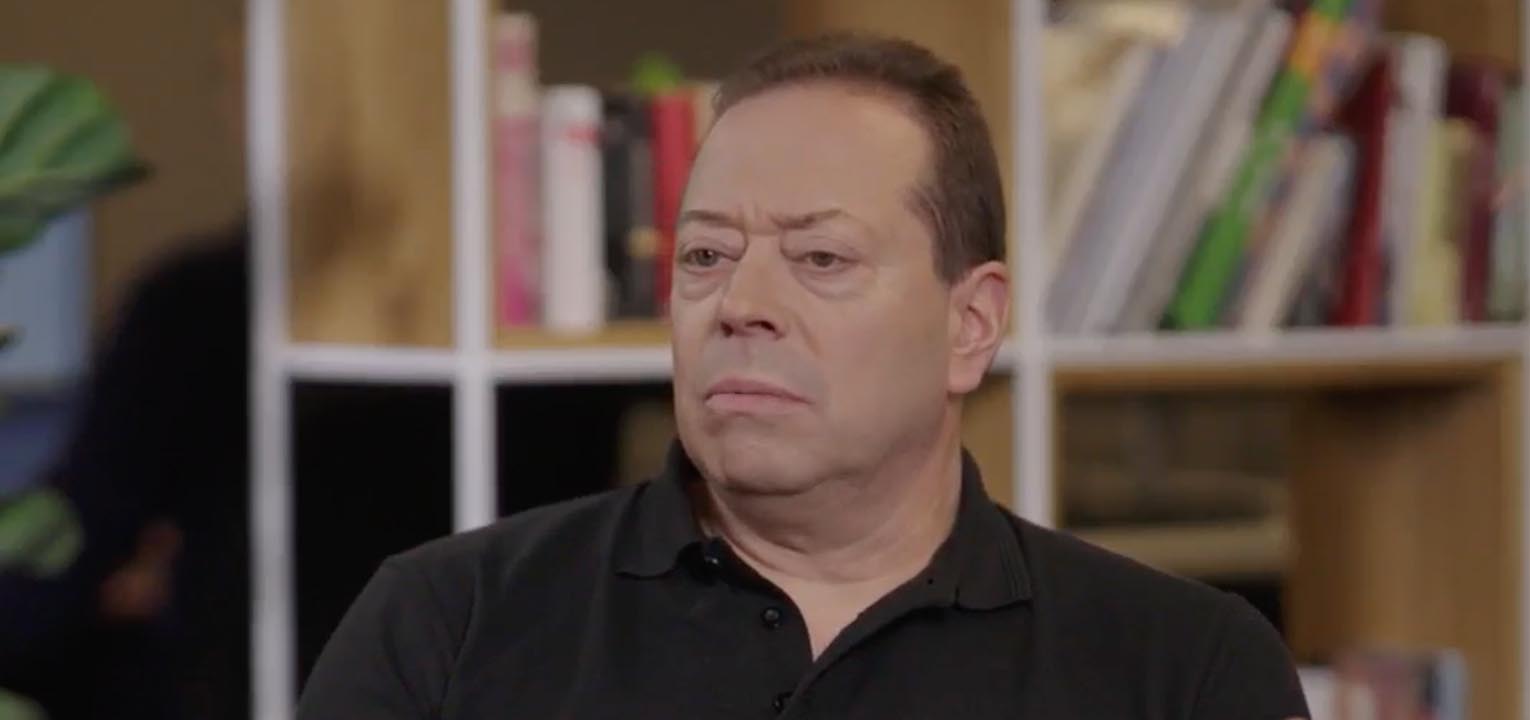

When Bank of Hawaii began reimagining their digital banking experience, they started with a fundamental question: What does an exceptional customer experience look like? In a recent conversation with David Hall, SVP and Director of Digital Experience, Innovation and Technology, he shared how this progressive institution is leveraging data to demonstrate deeper customer understanding and build trust.

A Framework for Success

Bank of Hawaii’s approach stands out for its thoughtful foundation. “Before we even got to the place where we could talk about technology and where we wanted to invest, we needed to understand what we were trying to accomplish,” Hall emphasized. This led to the development of their customer experience (CX) framework built on four key pillars: Value me, Know me, Advise me, and Inspire me.

This framework serves as their North Star, ensuring technology decisions align with customer needs rather than being driven by the allure of new capabilities. “Having that vision helps us not be enamored by the shiny new capabilities of technology,” Hall noted. “Instead, we can focus on the job to be done and the goal we’re aiming for and then make decisions about which technology is going to be best suited to help us accomplish that.”

Making Data Work for Customers

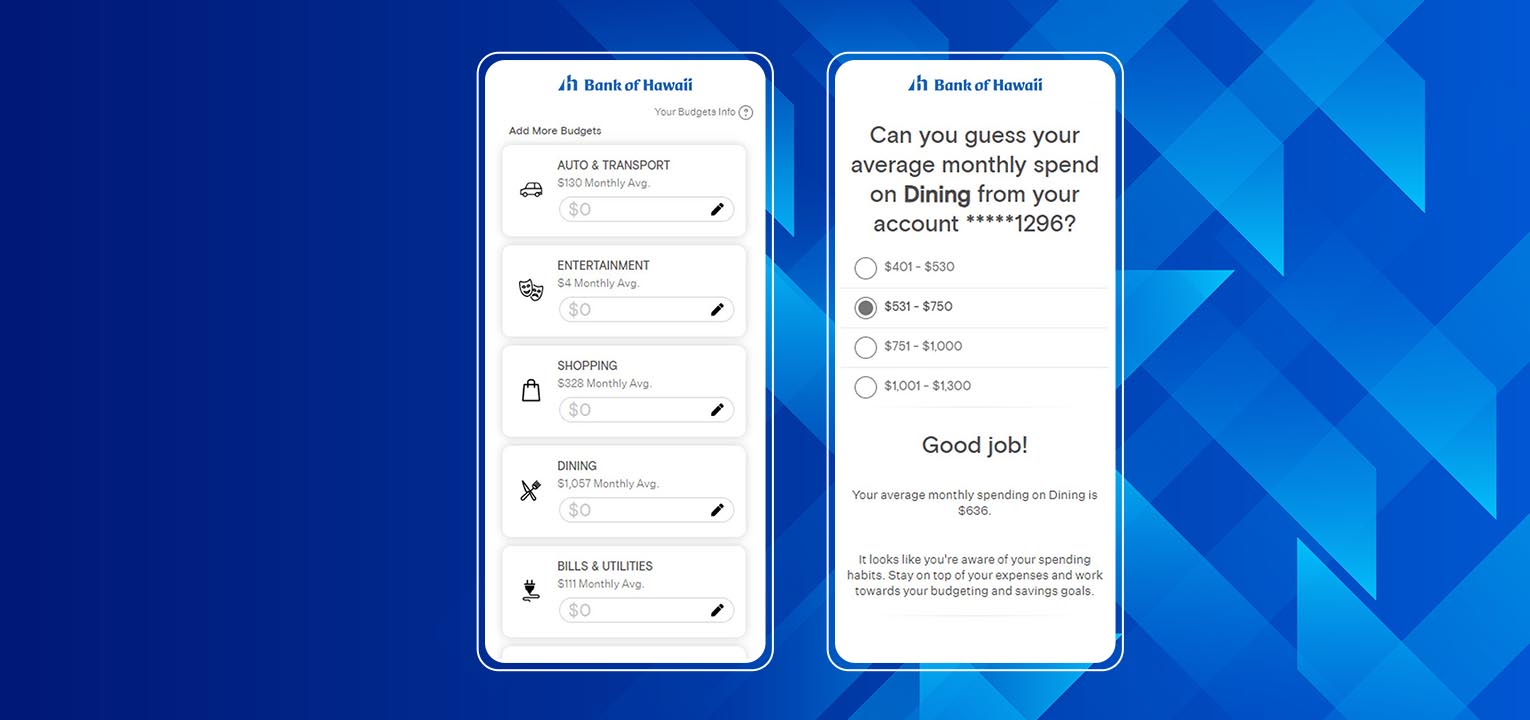

The bank’s implementation of personalized insights reflects this customer-first mindset. With access to over 50 insights initially and plans to expand to more than 60, Bank of Hawaii is focused on meaningful engagement rather than pure technology deployment.

For Hall, the opportunity is to engage with customers by educating them. “Not just to say, ‘Here’s a situation, good luck we hope you make the right decision.’ It’s more about ‘Here’s a situation, here are some options, here’s what we know, and here’s what we would recommend for you.’”

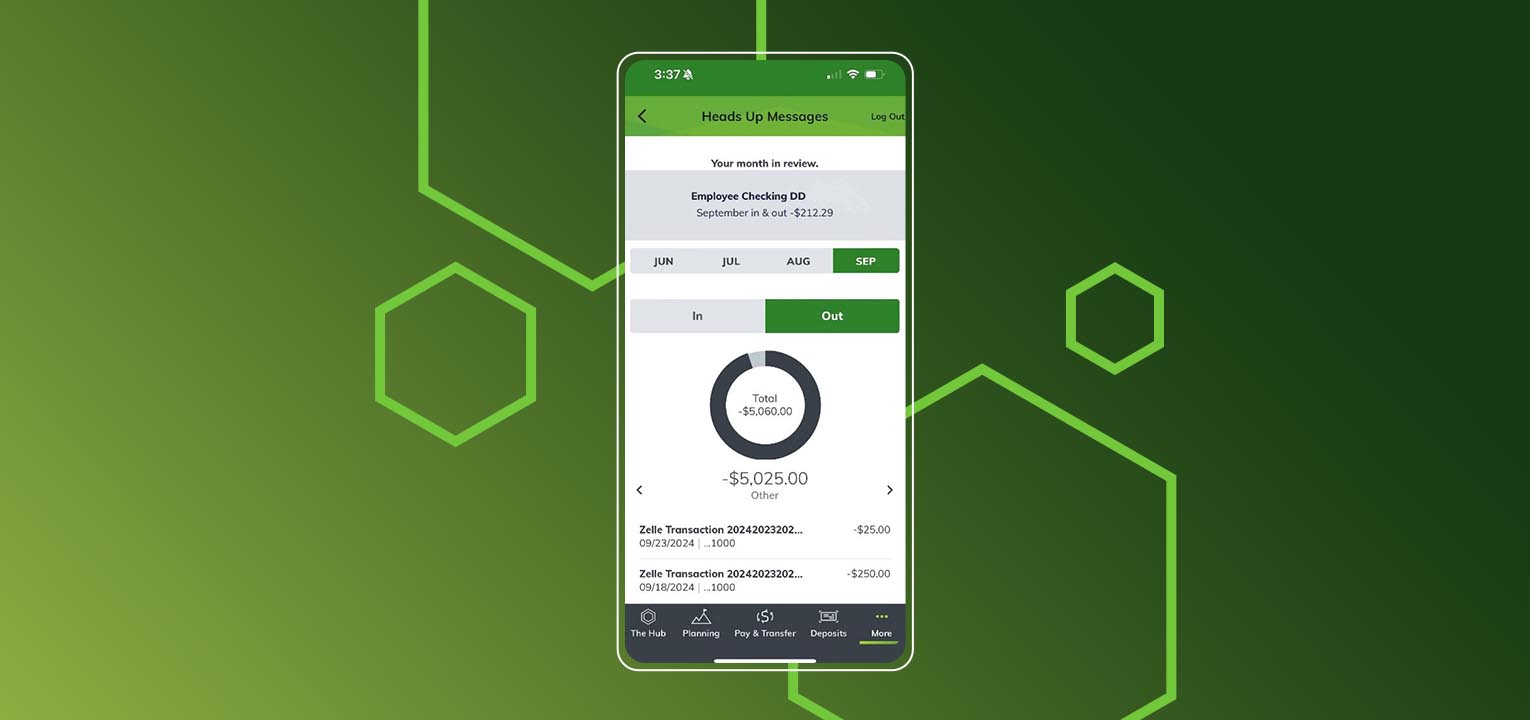

In Hall’s view, these meaningful insights give the customer something to come back and look for. Consequently, this increased engagement creates more opportunities for the bank to demonstrate value and deepen relationships.

Bank of Hawaii is particularly thoughtful about balancing sales opportunities with customer experience. While their sales and product teams are eager to use insights as a sales channel, Hall’s team ensures the focus remains on broader customer value: “We’re being very thoughtful about how we want to use insights because we don’t want it to ever feel to the customer like it’s just another place for us to be pushing products and services, even if they are meaningful and insightful.”

Beyond Basic Personalization

When describing what going beyond basic personalization really means, Hall hit the target with his analogy comparing a pencil drawing of a tree to a hyper-realistic acrylic or oil painting that customers would think is a photo.

In his view, “most general consumers don’t know a whole lot about finances, but they know that we know a lot about their finances. So they expect us to do a better job of giving them smart recommendations and guidance that help them improve their financial situation. Take, for example, double billing alerts or even quizzes; these real-time contextualized tips and insights are helping their customers become smarter about their finances and helping Bank of Hawaii to create the “oil painting” that delivers on their four CX framework pillars.

The Benefits of Partnering Through FIS

Bank of Hawaii’s partnership with Personetics through FIS has simplified execution. “The partnership that Personetics has with FIS made the decision even stronger for us,” Hall noted, highlighting how the embedded nature of the solution simplified their technology integration while maintaining security standards.

Looking Ahead

Although they are most of the way through their initial customer launch, the Bank of Hawaii already reported an increase in engagement due to their insights.

Their vision, however, extends beyond just providing insights, to showing a comprehensive understanding of their customers. “The next battlefield isn’t about who has the better rate or more branches,” Hall emphasized. “It’s about who knows our customers better and is able to actually meet those needs effectively.”

The Bank of Hawaii’s methodical approach to implementing customized insights, coupled with their clear focus on customer experience, demonstrates how banks can create stronger relationships through intelligent use of data. As digital banking continues to evolve, Bank of Hawaii’s customer-first framework offers a compelling roadmap for the future of personalized banking.

Watch David Hall’s full contribution to the discussion at the CBA webinar.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

What is Cognitive Banking?

Beyond Digital: Jim Marous on Why Banking Must Become Cognitive

Huntington Bank: A Masterclass in Data Enrichment and Customer Engagement

Jody Bhagat

President Global Banking

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.